how to cash a check online – You can use a checking account to cash a check. To do this, you’ll need your bank information or routing number and your checking account number. You may need to verify the checking account if it’s not the same as the one on file for your bank.

Imagine this: You are out at the grocery store and you get to the check-out line. You pull out your wallet and suddenly you find a crumpled piece of paper. It’s a check for $500, but you don’t have your checkbook with you. Forget about it! There is no need to worry because there are ways to cash a check without your checkbook.

The most common way is to use a bank’s website. Login using your account details and choose the option that says ‘Cash Checks’. Type in the amount of the check and follow the instructions from there. The other way is to go into a branch of that bank and ask them to cash it for you. They will need some ID (you can use an ID card or passport) and make sure they charge you for doing this for you ($2-$3).

How to Cash a Check

A check is a piece of paper that you write a monetary value on and then sign so that someone else can cash it for you. Checks are still used in the United States and Canada, but they have been replaced by other forms of payment, such as debit cards and credit cards, overseas. Checks are often used to pay for things like rent, mortgage payments, auto loans, and tuition. Checks can also be used to purchase goods or services from businesses.

The process of cashing a check can vary depending on the financial institution or store you choose. Typically you’ll need an accepted form of ID to cash a check, like a driver’s license or government ID. Generally, the only time you don’t need an ID is to deposit a check through an ATM or sign it over to someone else.

You don’t need to know how to write a check, but you need to endorse it. This is the first step to take after you’ve arrived at the location where you are cashing the check. To endorse the check, sign your name on the blank line located on the back of the check.

Hand your check and ID to the representative helping you. At a bank or credit union, this is the teller. If you’re depositing all or part of the check into your bank account, you need to fill out a deposit slip provided by the bank.

Why do I need to cash my check?

If you have a check you need to cash, there are a few steps to follow. First, find the routing number and account number on the bottom of your check. These numbers are necessary for your bank or credit union to process the transaction. Next, make sure the check is signed by someone with authority to endorse it. The amount should be clearly written on the front of the check in words and not numbers. If you want, you can also include your name and phone number on the back of the check if it doesn’t already have an endorsement line. Finally, bring your identification and any other supporting documentation to your bank or credit union as they may ask for this information as well as funds to cover processing fees.

How to Cash a Check at Your Bank or Credit Union

An account with a bank or credit union gives you a trusted spot to cash or deposit a check. Plus, most banks offer check cashing for free to their customers. If you bank locally, you can cash a check in person, but many banks also allow you to do this through an ATM if you prefer. Online banks typically don’t have branches you can visit to cash a check (or offer very limited branch access). Still, many allow you to deposit checks digitally through mobile banking apps.

How to Cash a Check at the Issuing Bank

You can also head to the bank or financial institution that issued the check. Look at the check for the issuing bank’s information. This service may be complimentary or provided for a small fee, depending on the bank. The issuing bank can immediately verify the availability of funds from the check source’s account. If a fee is charged, it’s typically deducted from the cash you receive.

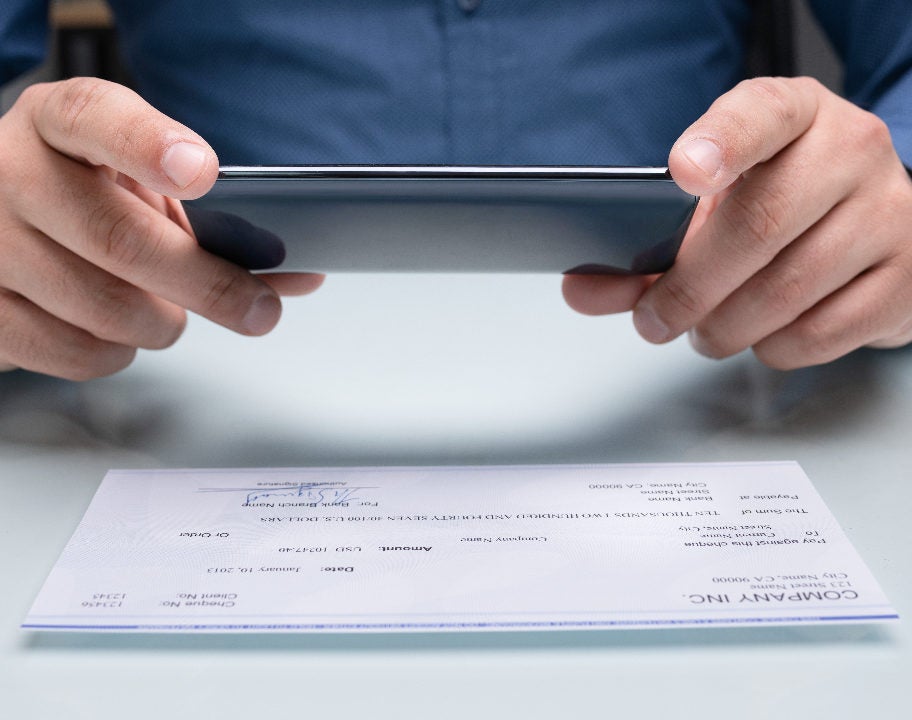

How to Cash a Check Online

Many, if not most, banks and credit unions offer a mobile app, allowing you to deposit checks electronically. Mobile check deposits typically involve taking photos of the check’s front and back using your mobile phone’s camera. Keep in mind that it’s a good idea to hold onto a check 14 days before you destroy it to ensure there are no issues with the deposit.

How to Cash a Check at a Retailer

Many retailers allow customers to cash checks at their locations. Walmart, for example, cashes checks and offers two options for receiving your money—in cash or loaded onto a Walmart MoneyCard. It costs $1 to purchase a MoneyCard in-store, or you can request one online to avoid the fee.

Walmart charges the following fees for cashing checks:

- Pre-printed checks up to $1,000: $4 fee

- Pre-printed checks over $1,000 up to a $5,000 max: $8 fee

- Two-party personal checks up to a $200 max: $6 or less

Some grocery store chains, like Kroger and its family of stores, also offer check-cashing services. At more than 2,000 Kroger-owned stores nationwide, you can cash select check types with a $5,000 maximum check total limit. Kroger check-cashing fees range from $4.00 to $7.50.

How to Cash a Check Through PayPal

You can cash a check through PayPal, if you have a PayPal Cash Plus account. Similar to mobile check deposits, you’ll use your phone to snap photos of your check. Then, submit the images to PayPal for review. If it’s approved, you can choose to add the funds to your PayPal account immediately, for a fee, or have it added in 10 days for no cost.

How to Cash a Check at a Check-Cashing Store

Payday loan stores are another way to cash a check, but consider using these as a last resort. They are often the most expensive option. Fees at check-cashing stores are generally a percentage of the check amount. These types of stores typically don’t list their fees online, so you won’t know how much it costs until you call or visit a location. But in some cases, interest rates can approach 400%.

Be sure to check with the financial institution or retailer for any restrictions, fees or limitations before you cash your check.

Do You Need a Bank Account to Cash a Check?

You don’t need to have a bank account to cash a check. That’s a boon for a large amount of the U.S. population without a banking relationship. A 2019 FDIC study revealed that more than seven million American households don’t have a bank account. In addition to cashing checks at the issuing bank, retail stores and check-cashing stores, here are a couple of other options to consider if you don’t have a bank account:

Prepaid card. Several prepaid cards allow you to add money via direct deposit, cash reload or mobile check deposit—some cards charge a fee for depositing checks. For example, the American Express Serve and Bluebird by American Express both offer a mobile check capture option:

- To receive the money in your prepaid account in 10 days is free.

- To have the check approved and paid within about an hour, there is a 1% fee on payroll and government checks with a preprinted signature and a 5% fee on all other checks; the minimum fee is $5.

Family member or friend. If you run out of options, you can always sign over your check to someone you trust, like a family member or close friend. Let them cash the check and give you the money.

Can I Cash a Check at an ATM?

Some banks may allow you to cash a check at an ATM, but it’s not a common practice. More often than not, you’ll need to deposit the check first and then pull available funds out of your account instead.

Every bank handles check cashing differently. Follow the on-screen instructions at the ATM if your bank offers this service. Remember to endorse the check before inserting it into the ATM.

Where to Avoid Cashing a Check

While check cashing and payday loan stores offer an alternative way to cash checks, they typically charge high fees that can add up quickly. Unless you’re in a bind, it’s best to avoid these types of establishments altogether. Opt to cash your check at your bank or another eligible financial institution.

Watch Out for Scams

Before you cash a check, verify that it’s legitimate. Your paycheck or government-issued checks are probably safe, but counterfeit checks are a common bank scam used to steal money from unsuspecting individuals.

Scammers may ask people to cash a check and send them the proceeds before anyone notices the check is fake. The worst part is that if you cash the check, you’ll likely be on the hook for the funds.

Best Long-term Solution: Get a Checking Account

While there are many ways to cash a check, the best option may be to get a checking account. A checking account gives you a place to deposit checks without fees charged by other check-cashing services.

Also, instead of carrying large amounts of cash in your pocket, your money is safely kept at your bank. Your checking account deposits are insured by the FDIC (Federal Deposit Insurance Corporation) up to the legal limits. Depositing checks into a checking account typically means your funds are easily accessible with a debit card.

Where can I go to cash my check?

There are many ways to get your check cashed.

The first and most obvious option is to cash your check at the bank or credit union where you have an account. If this is not possible, you can also try going to a store or company that offers check cashing services. You may also be able to find a local store that offers these services from their front desk.

It’s important to know that not every bank will provide check cashing services; make sure to call ahead in order to avoid any unnecessary inconvenience.

Conclusion

If you’re like most people, you will end up cashing at least one check in your lifetime. The process is a little more complicated than writing a check but it’s also much more secure. Your check won’t bounce if you follow these steps to cashing a check, so follow along and before you know it, you’ll have cash in your pocket!